USA

| The Lakes | ||

|

||

Real Estate is a High Order Capital Good and will be adversely affected by the economic depression, the over-supply, higher interest rates, lower real income and aging Baby boomers...but any crisis also offers opportunities and opportunities we have if we can buy NEW Homes at half the price it would cost to built them today......AND Real Estate is better than Fiat Paper Money and Treasuries. |

||

|

Bu This home comes with 4 beds/4baths, two car garage, installed kitchen, AC and central heating, central vacuum system, nice garden, up market area...more A house steps away from the Ocean?...Be advised there is a legislation being prepared where foreign Investors will get a Residence Visa when buying a property in the USA.

|

||

The housing market hasn't bottomed out yet. For the third quarter, the closely-watched S&P Case-Shiller national home-price index fell 16.6%, and experts are predicting further declines. Of the top 100 markets, here are 10 with the worst forecasts. Click here for more

Home values never went up. By artificially lowering the interest rates (Al Greenspan will go into history as the bubble creator by excellence) they basically printed money and gave it away to everyone. It was the ability to buy a higher loan that was increased, not the VALUE of the property. No one's income went up, in fact, because of the inflation, income came down.

According to a study of the Deutsche Bank by 2,011 half of the American home owners will be under water. The reason all this is important is that, if you’re underwater, you’re much more likely to default on your mortgage than if you have some equity.

Posted October 30, 2009

The worst U.S. housing crash since the Great Depression has led to a record number of foreclosures and shaved almost a third off property values. The S&P/Case-Shiller Index of 20 cities in August was 29 percent below its 2006 high, after rising for four consecutive months...click here for more...

Posted July 8, 2009 - Delinquencies on U.S. Home-Equity loans reach record.

July 7 (Bloomberg) -- Late payments on home-equity loans rose to a record in the first quarter as 18 straight months of job losses and a slumping economy left more borrowers unable to pay their debts, the American Bankers Association reported.

Delinquencies on home-equity loans climbed to 3.52 percent of all accounts from 3.03 percent in the fourth quarter, and late payments on home-equity lines of credit climbed to a record 1.89 percent, the group reported today. An index of eight types of loans rose for a fourth straight quarter, to 3.23 percent from 3.22 percent in October through December, the group said.

The number one driver of delinquencies is job losses...click here for more...

Posted June 7, 2009 - Take some time to watch this video clip!

xxxxxxxxxxxxxx

Posted June 4, 2009

Posted May 12, 2009

The median U.S. home price dropped 14% in the 1st quarter from a year earlier. The average median existing home price declined to $ 169,000 and distressed properties sell typically for 20% less than other homes on the market.

Posted May 1st 2009

Foreclosures keep rising. Those who even dare to hope we've seen the end of the real estate problems are in for a huge surprise.

Home sales are not any better....

Posted February 23, 2009

New York apartment prices are very high relative to the observable fundamentals. Using three alternative yardsticks-price/rent, price/income, and affordability-we find that prices would need to decline by 35%-44% to return to the valuation levels seen in the 1995-1999 period, before the start of the recent boom.

Under the (admittedly unrealistic) assumption that prices decline by the same percentage in each market segment, this type of drop would imply that a 1- bedroom condo whose price currently averages roughly $800,000 would decline to $480,000; a 2-bedroom condo would decline from $1.7 million to $1 million; and a 3-bedroom condo would decline from $3 million to $1.8 million.

As Manhattan is firing more and more people, the odds are that incomes will fall back to the pre-1986 level of 2 times the national average-and if national per capita income remained unchanged-prices would need to fall as much as 58% to return to the 1995-1999 price/income ratio.

Posted February 5, 2009

The Real Estate slump isn't over yet. Just like the Spanish banks, the American banks keep sitting on their foreclosures so they can spread the pain...click here for more...

Posted December 23, 2008

Sales prices for existing U.S. homes fell the most on record in November, tearing a deeper hole into households’ already tattered finances. The median resale price fell 13 percent from a year before, to $181,300, “probably the largest price decline since the Great Depression,” National Association of Realtors Chief Economist Lawrence Yun said in Washington. Sales slid to an annual rate of 4.49 million, lower than forecast.

New Home inventories are soaring to unseen levels:

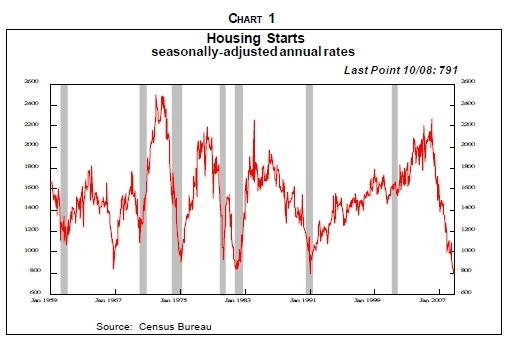

Posted December 17, 2008: New Home starts on an absolute minimum.

Posted November 26, 2008 : New-Home Sales Decline 5.3%

New-home sales tumbled 5.3% to the lowest level in 17 years during October, while prices kept retreating.

Posted September 18 and updated October 27, 2008

We start to see REAL SALES. Asking prices are half of what they were only a couple of years ago. Opportunities start to show! Foreign buyers are flocking into the USA and Florida to buy Real Estate. The number of homeowners ensnared in the foreclosure crisis grew by more than 70 percent in the third quarter of this year compared with the same period in 2007, according to data released Thursday. Nationwide, nearly 766,000 homes received at least one foreclosure-related notice from July through September, up 71 percent from a year earlier, said foreclosure listing service RealtyTrac Inc.

Posted September 4, 2008

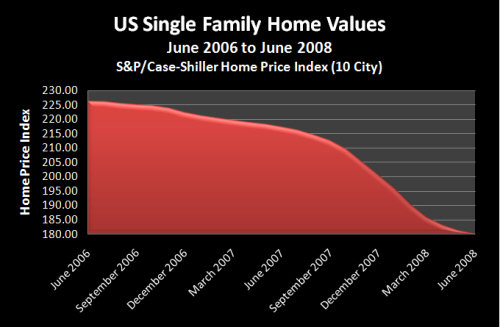

The decline in home prices hasn't been seen since the Great Depression, Gross said. That drop translates to an even bigger decline in overall wealth as the effects ripple through markets, Gross said. Home prices in 20 of the largest U.S. metropolitan areas fell 15.9 percent in June from a year earlier, according to an S&P/Case-Shiller index.

Posted August 5, 2008

Former Fed Chairman Alan Greenspan orchestrated the Real Estate bubble and hereby enabled the American economy to survive somewhat longer. Now that he has little political obligations left (does he?) his comments have become more reliable. Amazing is what he said last week: " The falling home prices in America are "nowhere near the bottom" – you can take to the bank. This may surprise some, especially since the national media just reported the single largest year-over-year drop in U.S. home prices, May's record 15.8% plunge. Even worse is that according to realtors, appraisers, homebuilders and mortgage brokers, the Home sellers still don't get it! Home prices didn't soar for any sound fundamental reason. They soared because of low interest rates, easy credit and a $500,000 capital gains tax exemption. (A misallocation of funds, in other words.)

Posted July 31, 2008

The American Real Estate market is in a really bad shape. Prices are coming down, and so has the dollar. In other words, we have ‘SALES’. More and more opportunities are seen, especially for the European Investor.

Waiver: The information at this site is provided solely for informational purposes and does not constitute an offer to sell, rent, or advertise real estate. The owner is not making any warranties or representations concerning any of these properties including their availability. Information at this site is deemed reliable but not guaranteed and should be independently verified. However, due to our experience, we are in a position to advice the potential investor as to where and how he should handle his planned American Real Estate investment(s), and how it can be rented out and maintained.

Indicative prices for the properties below range from $ 75.000/€ 50,000 to $ 250.000/€ 180,000

June home foreclosures up 53 percent

Thu Jul 10, 2008 6:12am EDT

By Helen Chernikoff

NEW YORK (Reuters) - Home foreclosure filings jumped 53 percent in June from a year earlier, although they were down 3 percent from May, and foreclosures are expected to rise further, real estate data firm RealtyTrac said on Thursday. Foreclosure filings rose on an annual basis in 39 states to a total of 252,363 properties during the month, with Nevada, California, Arizona and Florida posting the highest foreclosure rates. One out of every 501 U.S. households received a notice of default, auction sale or bank repossession in June, RealtyTrac said. "June was the second straight month with more than a quarter million properties nationwide receiving foreclosure filings," said James J. Saccacio, chief executive officer of RealtyTrac. "We have not yet reached the top of this foreclosure cycle."

Record drop in US home prices - AP - Jun 24 2008 9:02PM

New York - US home prices tumbled in April at the fastest rate since a widely followed index was begun in 2000 with all 20 metropolitan areas surveyed posting annual declines for the first time.

The Standard & Poor's/Case-Shiller home price index of 20 cities fell by 15.3% in April versus a year ago, according to Tuesday's report. Prices nationwide are at levels not seen since August 2004. The narrower 10-city index declined 16.3% in April, its biggest decline in its more than two-decade history.

Meanwhile, a report from the Office of Federal Housing Enterprise Oversight said US home prices fell 4.6% in April from the same month last year, when the index peaked. That marked the biggest decline ever in the agency's monthly index which dates back to January 1991. The government index is calculated using mortgage loans of $417 000 or less.

While the government report has shown nationwide price declines, the Case-Shiller index has shown far greater drops because it focuses on larger cities where prices rose further during the boom years, and includes riskier loans.

No surveyed city stayed above water, according to the Case-Shiller index. The last holdout, Charlotte, North Carolina, finally succumbed to the national housing downturn, with prices there slipping 0.1 percent from a year ago. Las Vegas and Miami both continue to post the largest declines, falling 26.8% and 26.7%, respectively.

However, the annual declines in Denver, Dallas and Cleveland were less severe than in the previous month, but Maureen Maitland, a S&P vice president, is reluctant to peg that as an indication of stabilization. "We wouldn't call a trend on one-month data," she said.

The report also showed prices in eight metro areas increased in April from March, but the gains could be seasonal blips as the home-buying spring season starts up rather than a sign of a turnaround, Maitland said. The housing slump, along with higher food and fuel prices and disruptions in the credit markets, has taken its toll on consumer sentiment.

An industry group Tuesday said US consumer confidence fell unexpectedly sharply in June to the fifth-lowest level ever. The Conference Board's reading of consumers' expectations also hit an all-time low.

- AP

US housing crisis deepens as foreclosures soar- June 13, 2008. Foreclosures add to the Credit Crunch, the Crack-up boom, the destruction of fiat money and will push up interest rates substantially in the near future. The problem ain't going away as the vicious circle is closed! By James Quinn, Wall Street Correspondent

America's housing crisis is reaching near-catastrophic levels as the number of people losing their homes and those seriously behind on mortgage payments soared last month.

One in almost every 500 American mortgage holders now has either lost their home or is on the verge of losing it, as the credit crisis claims victims throughout the US.

US banks repossessed almost three times as many homes in May as they did in the same month last year, taking control of 73,974 homes, against 28,548 in May 2007, according to a survey by RealtyTrac, the property research group.

The level of foreclosures - the legal process a bank begins to reclaim property after a mortgage holder falls badly behind on payments - rose by 48pc last month, the 29th consecutive month of year-on-year increases.

The states of Nevada, California and Arizona are the biggest victims of the housing crash. In Nevada, one in every 118 households received foreclosure notices in May. In Arizona, the figure was one in every 201 households.

The current crisis was sparked by an environment of low interest rates and lax lending practices among many mortgage brokers. As a result, and despite the US Federal Reserve reducing interest rates to 2pc from 5.5pc last September, a growing number of Americans cannot afford to meet their mortgage payments as the US economy continues to falter.

Inflation is adding to their woes, with the US Consumer Price Index rising 0.6 percentage points in May, up 4.2pc in the year, with core prices, stripping out fuel and food, up 0.2pc to 2.3pc.

U.S. Economy: Home Resales Decline, Inventories Jump (Update2) By Shobhana Chandra – Friday May 23, 2008

Sales of previously owned homes in the U.S. fell in April and the supply of unsold properties reached a record, signaling no let-up in the 27-month housing slump.

Purchases declined 1 percent to an annual rate of 4.89 million, higher than forecast, the National Association of Realtors said today in Washington. The median price fell 8 percent from April last year, the second-biggest drop.

``There is no indication that things are improving,'' said Christopher Low, chief economist at FTN Financial in New York, who forecast sales would drop to a 4.9 million pace. ``Inventories will stay out of balance at least until the end of 2009 and prices will keep falling.''

Defaults on subprime mortgages have prompted lenders to restrict credit, while falling property values have given buyers who are still able to get financing reason to delay purchases. The slide in home values may hurt consumer spending, which accounts for more than two-thirds of the economy.

Glut of Homes

The number of previously owned unsold homes on the market at the end of April jumped to 4.55 million from 4.12 million in March. The total represented 11.2 months' supply at the current sales pace, the highest on record and up from 10 months at the end of the prior month.

The median price of an existing home fell to $202,300 from $219,900 in April 2007.

``We had an unrealistic run-up of prices and the faster they come back down to the real world the better,'' William Cheney, chief economist at John Hancock Financial Services in Boston, said in an interview with Bloomberg Television. ``The faster prices come down, the quicker we can get back to an equilibrium where we actually have transactions.''

In Florida for a home purchased in 2006 at $350,000 the monthly payments are $3200 dollars at a 5% interest rate. Renting it out earns $1200 dollars a month. The asset you purchased does not pay for itself and in fact, it is the definition of insolvency--it consumes more than it produces. Year over year the Case -Shiller home prices index are down over 14%, declining at a 24% rate.